Financial planning is an integral component of operating a successful property management business. It involves strategizing, budgeting, and forecasting finances to ensure that you're mitigating risk while making the best decisions for long-term stability and growth. For property managers who are looking to make sound financial decisions, it's essential to develop effective strategies for managing their operations' funds and resources. From accurately forecasting income to minimizing tax burden, there is a wide range of considerations when it comes to structuring your financial plans. At RealCube we understand the challenges associated with developing robust financial planning strategies. Let us break down what this process entails.

When it comes to managing property successfully and efficiently, having a robust financial strategy in place is essential. Having an effective financial management plan can be beneficial for property managers, reducing their stress levels while improving their overall effectiveness. It ensures all bills are paid on time and that resources are being used as efficiently as possible, helping make the most of a tight budget. With a good financial plan in place, property managers can easily track expenditure and assets, enabling them to quickly spot any potential problems or areas for improvement. Good financial planning also ensures cash flow remains stable and business operations remain competitive - a huge benefit for those in the industry. RealCube's software solution is the perfect choice for achieving these benefits of financial management with ease.

Creating an effective financial plan for your property management business begins with a thorough assessment of your current financial health. This will involve gathering and analysing all relevant data, including income and expenses, assets and liabilities, cash flow projections, and more. Once you have a clear understanding of where you stand financially, it's time to set realistic goals based on these numbers. This could include reducing debt, increasing cash flow, or investing in certain areas of the business. The next step is to develop a detailed plan that outlines specific steps for achieving these goals. This should involve budgeting, strategizing how income will be allocated and forecasting future costs. It's also essential to stay on top of any changes in regulations or taxes that could affect your finances. One way to approach this is through advanced financial management software, such as RealCube's property management platform.

Risk management is an important part of developing a successful financial plan for property managers. This process involves assessing potential risks, determining how likely they are to occur and putting safeguards in place to reduce their impact. Risk management helps to minimize financial losses, creating a more stable and secure business, which is essential for long-term success. Examples of risk management strategies include diversifying investments, implementing insurance policies, setting aside funds for contingencies and having back up plans should unexpected events occur. This advanced financial management practice helps to ensure that property managers are well-prepared for any scenario.

Having adequate insurance is an essential part of any effective financial plan. It can help protect against many potential risks and losses, ensuring your business remains financially secure. The type of coverage you need will depend on the specifics of your business and operations, so it's important to do thorough research into the available options before making a decision. Common forms of insurance for property managers include liability coverage, property and casualty insurance, workers’ compensation insurance and business interruption insurance. While these are not all-encompassing, they can provide a solid foundation for your financial plan.

Having an effective financial strategy in place is essential for property managers to remain successful and competitive. Developing a robust financial plan involves assessing current finances, setting goals, creating a budget and implementing strategies for risk management. It's also important to remember the role insurance can play in protecting your business from unexpected losses. With a good financial plan and the help of RealCube's software solution, property managers can remain financially secure while achieving long-term success.

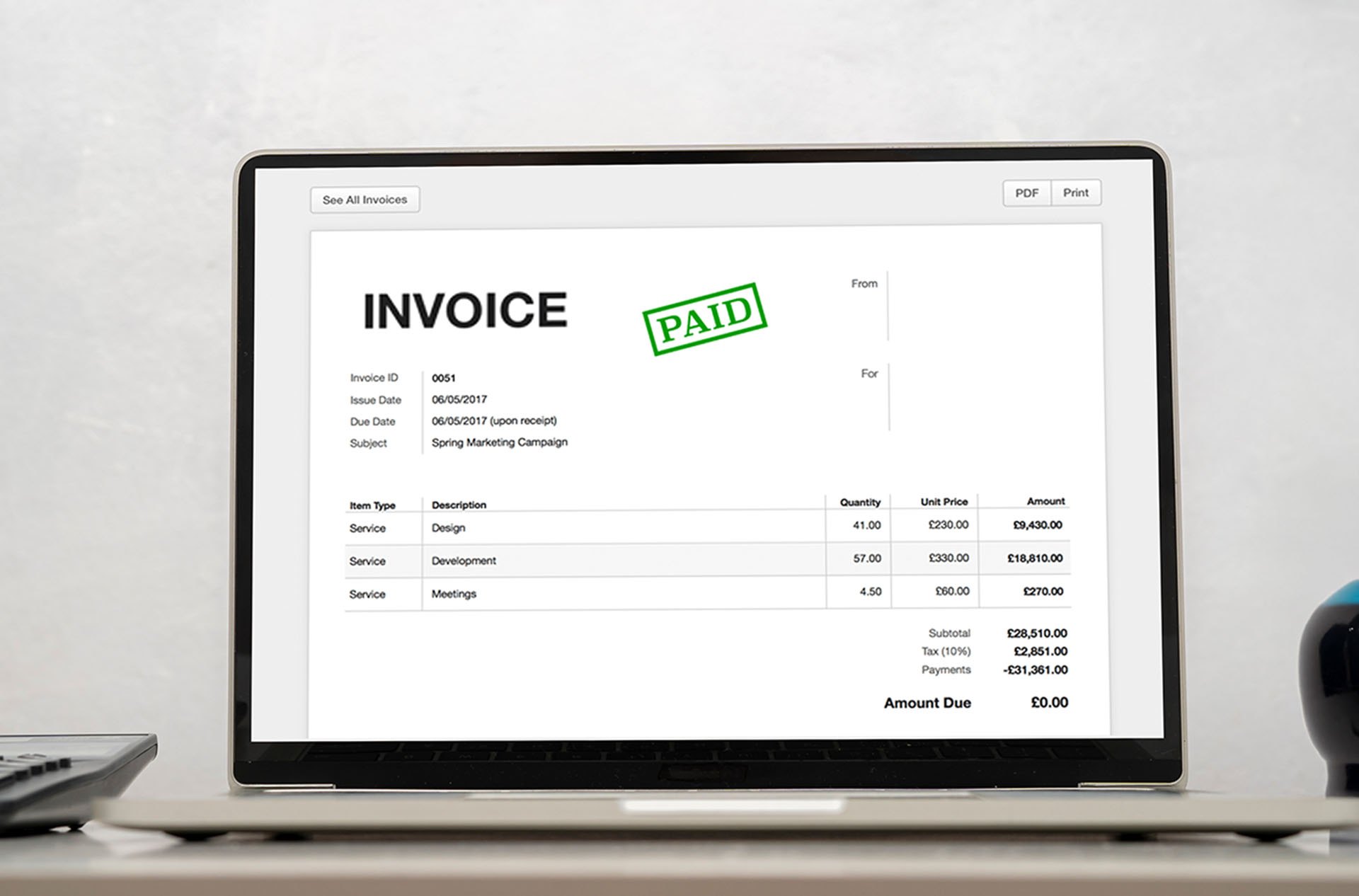

RealCube's software is a must-have for property managers, designed to optimize and simplify financial operations. It gives you an in-depth look at your current funds, helping you spot potential problems before they become serious. With features like automated invoicing, digital payments and detailed reporting, RealCube makes it easier than ever to manage your business's financial health. From generating regular reports to tracking expenses, RealCube has all the tools you need for successful financial planning.

To learn more about our solution and how it can help you achieve your financial goals, contact us today.

Introduction to Digital Invoicing Why do some property managers still manually type up billing…

Introduction Let’s face it — managing property accounts and billing isn’t exactly a walk in the…

Let’s face it: managing properties used to be a mess. From chasing rent checks to tracking expenses…

Managing a real estate portfolio with multiple properties is like juggling flaming torches—exciting…

Managing property finances can be difficult for real estate agents, property managers, and landlords.…

In an era where many startups race to achieve unicorn status primarily through lofty valuations, RealCube…

The Middle East, known for its visionary leadership and commitment to growth, has been making significant…

In today's rapidly evolving real estate landscape, the importance of robust financial management in…

In recent years, the financial benefits of strategic management have become more and more apparent.…

The process of paying rent in Dubai is about to get a lot simpler and more efficient, thanks to the…