As a property management company, it is essential to have a good understanding of financial concepts and practices in order to make sound decisions about your business. But what is accounting and financial management? Financial management is the process of organizing and managing the financial resources of a company. This includes recording income and expenditure, budgeting, forecasting future earnings, and assessing risk. In this blog post, we will discuss the role of financial management in property management companies, and how you can maintain accurate records of income and expenditure. We will also look at some tips for reducing costs and increasing profits. Finally, we will explore the benefits of using accounting software for property management companies.

Financial management plays a vital role in property management companies. It is responsible for ensuring that the company has enough financial resources to meet its obligations, and that these resources are used efficiently and effectively. Financial management also helps property management companies to make sound investment decisions, by providing information on past performance and future prospects.

In order to make informed decisions about your finances, it is important to maintain accurate and up-to-date records of income and expenditure. This will give you a clear picture of your current financial position, and allow you to identify any areas where costs can be reduced. There are a number of ways to do this, including using accounting software, keeping manual records, or outsourcing your accounting to a professional.

A good understanding of financial concepts is essential for all property management companies. This knowledge will enable you to make sound decisions about your finances, and understand the implications of these decisions. Without this understanding, you may make decisions that could put your company at risk.

There are a number of key financial management practices that all property management companies should adopt in order to manage their finances effectively. These include:

- Maintaining accurate and up-to-date records of income and expenditure - this will give you a clear picture of your current financial position, and enable you to identify any areas where costs can be reduced.

- Budgeting - this will help you to allocate your resources effectively, and ensure that you do not overspend.

- Assessing risk - it is important to identify and assess any risks that could have a negative impact on your company's finances.

- Forecasting future earnings - this will enable you to make informed decisions about investment and expenditure.

In order to manage their finances effectively, all property management companies should adopt these key financial management practices. By doing so, they can ensure that their company is stable and financially secure.

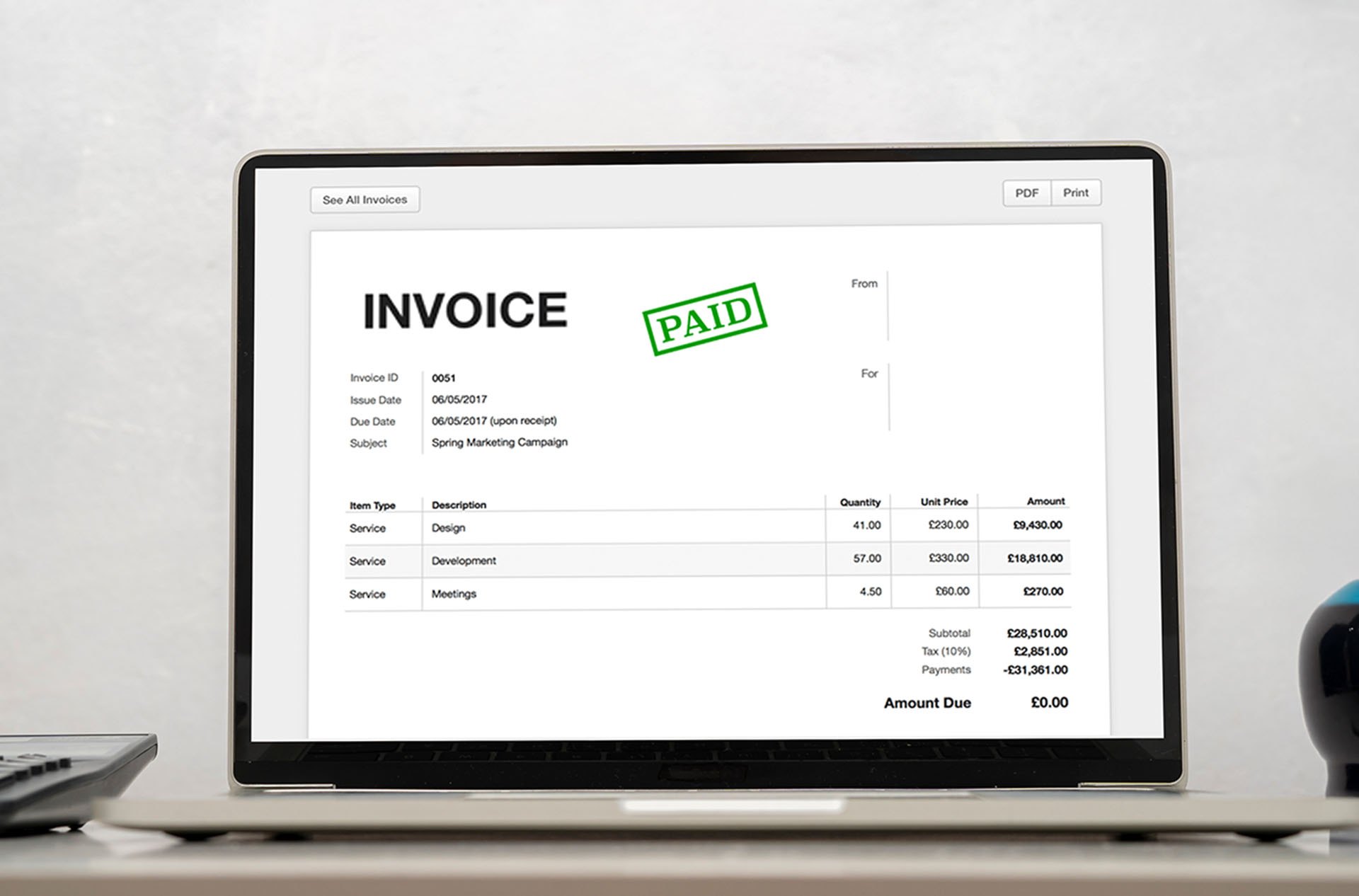

One of the best ways to manage your finances effectively is to use accounting software. This type of software can automate many of the tasks associated with financial management, such as record-keeping, invoicing, and payments. Property management accounting software can also provide valuable insights into your financial position, and help you to make informed decisions about your finances.

There are a number of different accounting software packages available, and it is important to choose one that is suitable for your company's needs. Many property management companies use off-the-shelf software such as Quickbooks or Xero. However, there are also a number of specialist software packages available that are designed specifically for property management companies. RealCube is one of the leading providers of accounting software for property management companies.

Overall, accounting software can save you a considerable amount of time and effort when it comes to managing your finances. It can also provide valuable insights into your financial position, and help you to make informed decisions about your finances. If you are not already using accounting software, we would strongly recommend that you consider doing so.

In conclusion, financial management is essential for all property management companies. By maintaining accurate records, budgeting effectively, and assessing risk, property management companies can ensure that they are making sound decisions about their finances. Additionally, by using accounting software, property management companies can automate many of the tasks associated with financial management.

Do you want to learn more about RealCube and how our software can help you to manage your finances effectively? If so, please get in touch. We would be happy to provide you with a free demonstration.

Introduction to Digital Invoicing Why do some property managers still manually type up billing…

Introduction Let’s face it — managing property accounts and billing isn’t exactly a walk in the…

Let’s face it: managing properties used to be a mess. From chasing rent checks to tracking expenses…

Managing a real estate portfolio with multiple properties is like juggling flaming torches—exciting…

Managing property finances can be difficult for real estate agents, property managers, and landlords.…

In an era where many startups race to achieve unicorn status primarily through lofty valuations, RealCube…

The Middle East, known for its visionary leadership and commitment to growth, has been making significant…

In today's rapidly evolving real estate landscape, the importance of robust financial management in…

In recent years, the financial benefits of strategic management have become more and more apparent.…

Financial planning is an integral component of operating a successful property management business.…